Executive Insights

- Gold hit an all-time high of ~$5,600 before correcting to ~$5,230 on Jan 30, 2026.

- The gold rate in Pakistan reached a historic peak of Rs. 579,500 per tola.

- Analysts predict gold could rebound and test $6,000 later in 2026.

- Major market drivers include geopolitical tension, central bank buying, and currency fluctuation.

- Investors are advised to watch the $5,000 support level closely.

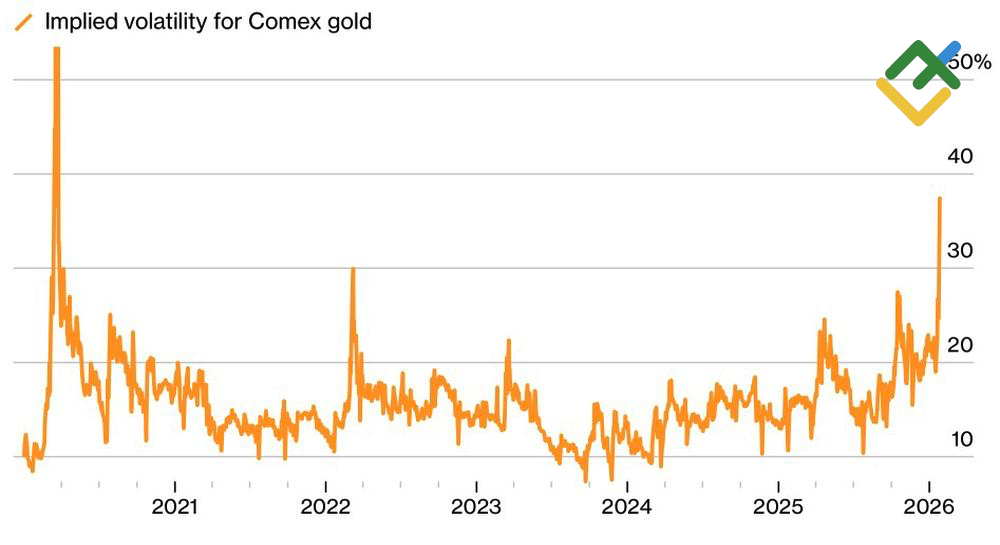

The Gold Price Today has experienced significant volatility, retreating from a record high of nearly $5,600 per ounce earlier in the session. As of January 30, 2026, gold is trading in a turbulent range, reacting to profit-taking and shifting geopolitical signals.

📉 Live Gold Prices (January 30, 2026)

Below are the latest spot rates for gold in the international market and local markets in Pakistan.

| Market / Unit | Price (Approx.) | 24h Change |

|---|---|---|

| International Spot (XAU/USD) | $5,230.12 – $5,353.49 | ▼ 3.50% |

| Pakistan (24K per Tola) | Rs. 579,500 | ▲ Rs. 21,200 (Intraday High) |

| Pakistan (24K per 10 Grams) | Rs. 496,840 | ▲ Rs. 18,175 |

| Pakistan (22K per Tola) | Rs. 531,205 | ▲ High Volatility |

Note: Prices are subject to rapid fluctuation during the trading session. The Pakistan rates reflect the opening rally before the international correction took full effect.

📊 Market Analysis: Why is Gold Volatile Today?

Gold’s performance on January 30, 2026, has been defined by a dramatic surge to a new all-time high of $5,595.42, followed by a sharp correction toward the $5,230 level. Several key factors are driving this erratic behavior:

- Profit Taking: After hitting the psychological resistance near $5,600, institutional investors initiated a sell-off to lock in gains, triggering a 3.5% drop in international spot prices.

- Geopolitical Tensions: Escalating global conflicts initially drove the safe-haven rally, pushing prices up by over 20% in the last month alone.

- Currency Fluctuations: The US Dollar’s weakness earlier in the week supported the rally, but a sudden rebound in the Dollar Index (DXY) today has put pressure on bullion.

🇵🇰 Gold Rate in Pakistan Today

In Pakistan, gold prices reached historic peaks today, driven by the international rally and the depreciation of the Rupee. The per tola price of 24K gold surged to Rs. 579,500. However, local jewelers are warning of a potential sharp correction tomorrow if the international drop to $5,230 sustains through the close.

Local Market Breakdown

- 24 Karat (Fine Gold): Best for investment bars and biscuits. Current Rate: Rs. 579,500/tola.

- 22 Karat: Standard for jewelry making. Current Rate: Rs. 531,205/tola.

- 21 Karat: Often used for intricate jewelry designs. Current Rate: Rs. 507,065/tola.

🔮 Gold Price Forecast: Will It Hit $6,000?

Despite today’s pullback, the broader outlook for 2026 remains bullish. Analysts from major financial institutions like J.P. Morgan and Bank of America have revised their targets upward.

- Short-Term (Q1 2026): Prices are expected to consolidate between $5,000 and $5,400 as the market digests the recent rally.

- Mid-Term (2026 Target): Many forecasts point to gold testing the $6,000/oz level later this year, driven by sustained central bank buying and expected interest rate cuts.

- Institutional Sentiment: Citigroup and Goldman Sachs maintain a “Buy” rating, viewing the current dip to $5,230 as a strategic entry point for long-term investors.

💰 Investment Verdict: Buy the Dip?

Aggressive Investors: The drop to $5,230 offers a high-risk, high-reward entry point, betting on a rebound back to $5,500.

Conservative Investors: Wait for stability. If the price holds above $5,000 for the next 48 hours, the uptrend remains intact. A break below $4,990 could signal a deeper correction.

In-Depth Q&A

Q: What is the gold price today in Pakistan?

As of January 30, 2026, the gold price in Pakistan for 24K gold is Rs. 579,500 per tola and Rs. 496,840 per 10 grams.

Q: Why did gold prices drop suddenly today?

After hitting a record high near $5,600, gold prices faced a sharp correction due to profit-taking by institutional investors and a rebound in the US Dollar.

Q: Will gold prices reach $6,000 in 2026?

Yes, many analysts forecast gold to reach or exceed $6,000 per ounce in 2026, citing geopolitical instability and central bank accumulation as key drivers.

Q: Is today a good time to buy gold?

With the price dipping to around $5,230 from highs of $5,600, market experts suggest this could be a buying opportunity for long-term investors, though short-term volatility is expected.

Q: What is the difference between 24K and 22K gold rates?

24K gold is 99.9% pure and used for investment (bars/coins), priced today at Rs. 579,500/tola. 22K gold contains 91.6% gold mixed with other metals for durability (jewelry) and is priced at Rs. 531,205/tola.