In a significant development shaking up the athletic apparel industry, Toronto-based Fairfax Financial Holdings has acquired approximately 22% of Under Armour’s (NYSE: UAA) Class A shares, signaling strong investor confidence in the company’s ongoing restructuring. This strategic investment, revealed in early January 2026, aligns with Under Armour’s efforts to rebound from recent challenges like declining sales and fierce competition from brands such as Nike and Adidas. Led by Prem Watsa, often called the “Warren Buffett of Canada,” Fairfax’s move has driven a notable stock surge, highlighting opportunities in the sportswear sector. This comprehensive guide explores the acquisition details, background, market impact, and future implications, providing expert insights for investors and industry watchers.

Background on Fairfax Financial and Prem Watsa: The “Warren Buffett of Canada”

Fairfax Financial Holdings, a leading Canadian investment firm based in Toronto, specializes in insurance, reinsurance, and value-driven investments. Established in 1985 by Prem Watsa, a renowned billionaire investor known for his contrarian strategies akin to Warren Buffett, the company manages over $80 billion in assets. Watsa’s approach emphasizes long-term value in undervalued companies, with a history of successful turnarounds in sectors like finance and consumer goods.

Fairfax’s interest in Under Armour isn’t new; it previously held a smaller position but ramped up to this substantial stake through targeted purchases. As per SEC disclosures, Fairfax now controls 41,958,923 Class A shares, representing about 22.2% of Under Armour’s Class A common stock. This positions Fairfax as a key shareholder, potentially influencing the athletic wear brand’s trajectory without immediate activist intentions. The investment reflects Watsa’s belief in Under Armour’s brand strength amid the broader fitness and apparel market recovery.

Details of the Under Armour Fairfax 22% Stake Acquisition

The acquisition was formally announced via a Schedule 13D filing with the U.S. Securities and Exchange Commission on January 5, 2026. This regulatory document highlights Fairfax’s beneficial ownership and passive investment stance, though market analysts speculate it could evolve. Key acquisition specifics include:

- Stake Size: 41,958,923 Class A shares, equating to 22.2% based on 188,834,386 outstanding shares as of October 31, 2025.

- Purchase Timeline: Accelerated buys in late December 2025 and early January 2026, including over 13 million shares valued at around $67 million.

- Strategic Rationale: Fairfax sees Under Armour as an undervalued opportunity in the sportswear industry, leveraging its innovative products like moisture-wicking fabrics and global brand appeal.

This Toronto-based firm’s 22 percent stake in Under Armour underscores cross-border investment trends in consumer discretionary stocks, particularly in athletic apparel and fitness gear.

Under Armour’s Turnaround Efforts: Challenges and Opportunities in Athletic Apparel

Founded in 1996 by Kevin Plank in Baltimore, Maryland, Under Armour pioneered performance apparel with technologies like compression clothing and connected fitness products. However, recent years have brought hurdles, including supply chain issues, e-commerce shifts, and competition in the sportswear market. Fiscal 2025 reported revenue declines, contributing to a stock drop of over 40%.

Under Plank’s renewed leadership since 2024, the company is executing a robust turnaround strategy:

- Innovation Focus: Enhancing product lines in footwear, outerwear, and activewear to capture market share.

- Operational Efficiency: Cutting costs, optimizing inventory, and improving profit margins.

- International Growth: Expanding in high-potential regions like Asia and Europe, where demand for athletic wear remains strong.

- Performance Incentives: Plank’s compensation links to stock milestones, such as reaching $13 per share by 2028.

Experts from firms like UBS view Under Armour as a prime turnaround candidate in the fitness industry, bolstered by post-pandemic wellness trends. Fairfax’s involvement adds credibility, potentially accelerating these initiatives.

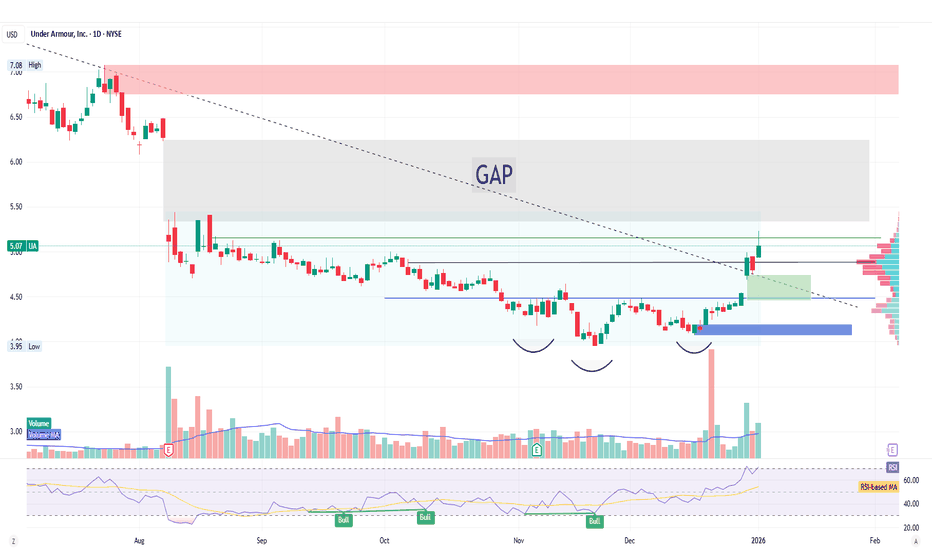

Market Reaction and Stock Performance Following the Stake Disclosure

The announcement ignited immediate market enthusiasm. Under Armour’s UAA shares rose up to 14% in after-hours trading on January 5, 2026, with sustained gains in following sessions. UA Class C shares mirrored this upward trend, reflecting optimism in the apparel sector.

Social media buzz on platforms like X amplified the sentiment, with discussions praising Watsa’s investment acumen and speculating on future collaborations. Overall, investor confidence surged, viewing the stake as a vote of approval for Under Armour’s recovery in the competitive sportswear landscape.

Implications for Investors: Is the Prem Watsa Under Armour Investment a Buy Signal?

This Canadian investor’s stake in Under Armour presents a compelling value proposition for portfolio managers and retail investors alike. Watsa’s track record in undervalued assets suggests potential upside, but risks like ongoing revenue pressures and market volatility persist. Wall Street analysts maintain a “Hold” rating, with upgrades from Guggenheim and UBS citing improved fundamentals.

Critical watchpoints include:

- Earnings Reports: Insights into sales growth in athletic apparel categories.

- Shareholder Dynamics: Any activist shifts from Fairfax.

- Industry Trends: Economic factors affecting consumer spending on fitness gear.

This move highlights opportunities in U.S.-Canadian investment synergies within the consumer goods sector.

Conclusion: Fairfax’s Stake Paves the Way for Under Armour’s Revival

Fairfax Financial’s acquisition of a 22.2% stake in Under Armour marks a pivotal endorsement for the sportswear company’s turnaround under Kevin Plank. With Prem Watsa’s expertise injecting stability and optimism, Under Armour is well-positioned to overcome challenges in the athletic apparel market and capitalize on global fitness trends. As the industry evolves, this partnership could drive long-term value, making it a storyline to follow closely in 2026 and beyond. Investors should weigh the potential rewards against inherent risks, always prioritizing diversified strategies.

This article draws on the latest SEC filings, market analyses, and industry reports as of January 7, 2026. It is for informational purposes and not financial advice. Consult a certified advisor for personalized investment decisions.

Frequently Asked Questions (FAQ) About Fairfax’s 22% Stake in Under Armour

What is Fairfax Financial’s stake in Under Armour?

Fairfax Financial Holdings owns approximately 22.2% of Under Armour’s Class A shares, totaling 41,958,923 shares as disclosed in a January 5, 2026, SEC filing.

Who is Prem Watsa and why is he called the “Warren Buffett of Canada”?

Prem Watsa is the founder and CEO of Fairfax Financial, a Toronto-based investment firm. He’s nicknamed the “Warren Buffett of Canada” for his value investing style, focusing on undervalued companies with long-term potential, similar to Buffett’s approach at Berkshire Hathaway.

How did Under Armour’s stock react to the Fairfax investment?

Under Armour’s shares (UAA) surged up to 14% in after-hours trading following the announcement, with positive momentum continuing, reflecting investor confidence in the company’s turnaround.

What are Under Armour’s main turnaround strategies?

Under CEO Kevin Plank, strategies include product innovation in athletic wear, cost reductions, global expansion, and tying executive incentives to stock performance milestones.

Is Fairfax planning to take an activist role in Under Armour?

Currently, Fairfax has stated the investment is passive for portfolio purposes, but given Prem Watsa’s history, some analysts speculate potential future involvement in corporate decisions.

Why did Fairfax invest in Under Armour?

Fairfax views Under Armour as an undervalued asset in the sportswear industry, with strong brand potential amid recovery efforts and market opportunities in fitness and apparel.

What risks should investors consider with Under Armour stock?

Key risks include ongoing revenue declines, competition from Nike and Adidas, supply chain issues, and broader economic factors impacting consumer spending on athletic gear.